Citizenfund invites you to take back control of finance.

The Citizenfund offers everyone the opportunity to take back control of finance and become an actor of change by financially supporting the companies of tomorrow.

By putting a fraction of your savings into our fund,

you support ambitious entrepreneurial projects with a social or environmental impact beneficial to society.

By investing, you become a de facto associate of the Citizenfund.

The subscription of shares is a way of making your savings available rather than a speculative investment or a philanthropic donation. The social return of your investment is guaranteed, and a financial return of up to 6% is possible (according to our CNC approval, Royal Decree of 8 January 1962, art.1), but is in no way guaranteed.

• B shares at €250 (+€10 one-off management fee per share) for everyone

• C shares at €50 (+€2 one-off management fee per unit) for persons under 26 years of age at the time of subscription.

The Citizenfund operates according to the cooperative governance principle

« 1 person = 1 vote ».

Each cooperator has the same voting power, regardless of the type of share and the amounts invested, for both investment decisions and internal governance.

As a cooperator, you own a share of the Citizenfund.

You can then vote for projects to be financed and for governance decisions, on the principle of 1 person = 1 vote.

You can also take on other roles:

EXAMINATOR

You join our selection committee as an elected cooperator or as an expert in a specific field.

OBSERVER

You are following up on one of the projects financed by the Citizenfund.

ADMINISTRATOR

You represent cooperators B and C on the Board of Directors.

At any time, and depending on your availability, you can also respond to our calls to make your skills available to the Citizenfund, or submit projects with a societal impact.

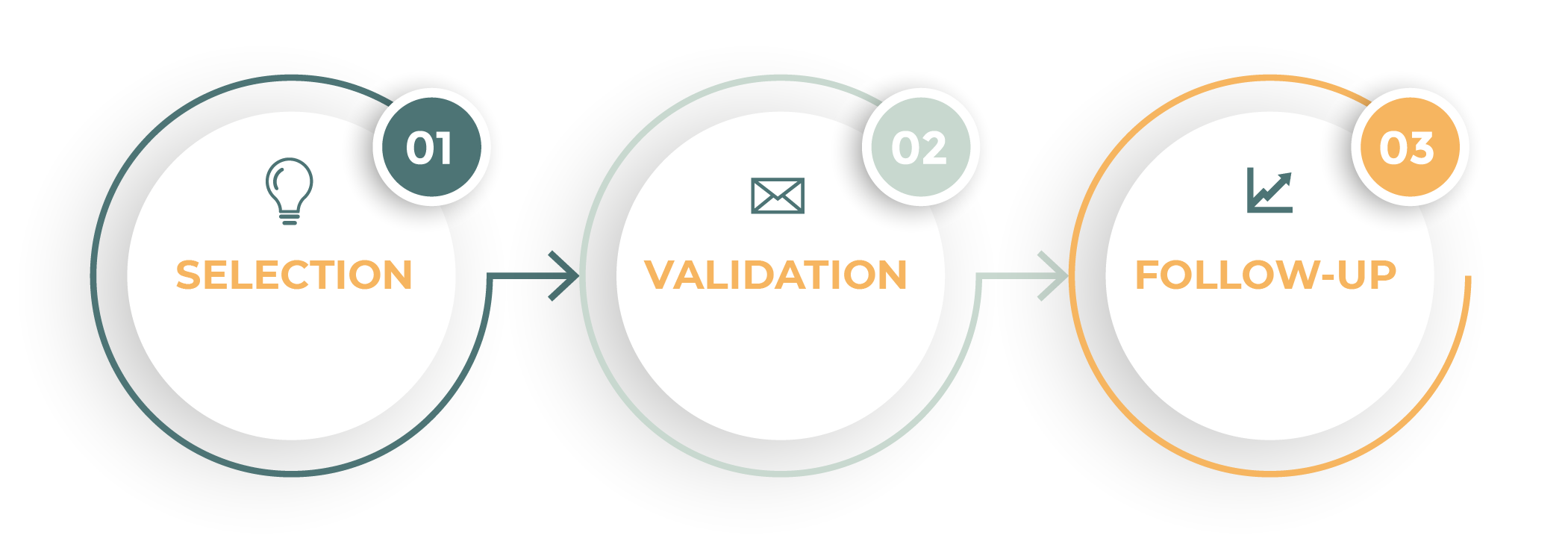

Our triple-checking process

At Citizenfund, it’s our cooperators who choose the companies the fund finances.

The triple-checking process we’ve put in place means we can rely entirely on the collective intelligence to make financing decisions.

1. After an initial meeting and screening by the operational team, the Selection Committee verifies that the entrepreneur and his project correspond to the Citizenfund’s values by evaluating it on 5 criteria.

2. Our cooperators-investors meet the entrepreneur and his project and challenge them in a friendly manner. They then vote during 10 days on our site for or against the financing of the social enterprise by the Citizenfund. If the majority is in favour of the project, it will be financed. The majority wins.

3. An elected cooperator-investor then takes over by becoming an observer. His role is to monitor a financed project, hand in hand with the entrepreneur and the Citizenfund’s operational team.